WELCOME TO

SHAMROCK

WELCOME TO

SHAMROCK

SHAMROCK

Find your path to career growth at our

family-owned company.

family-owned company.

OVER 100 YEARS OF CARING

FOR OUR ASSOCIATES.

FOR OUR ASSOCIATES.

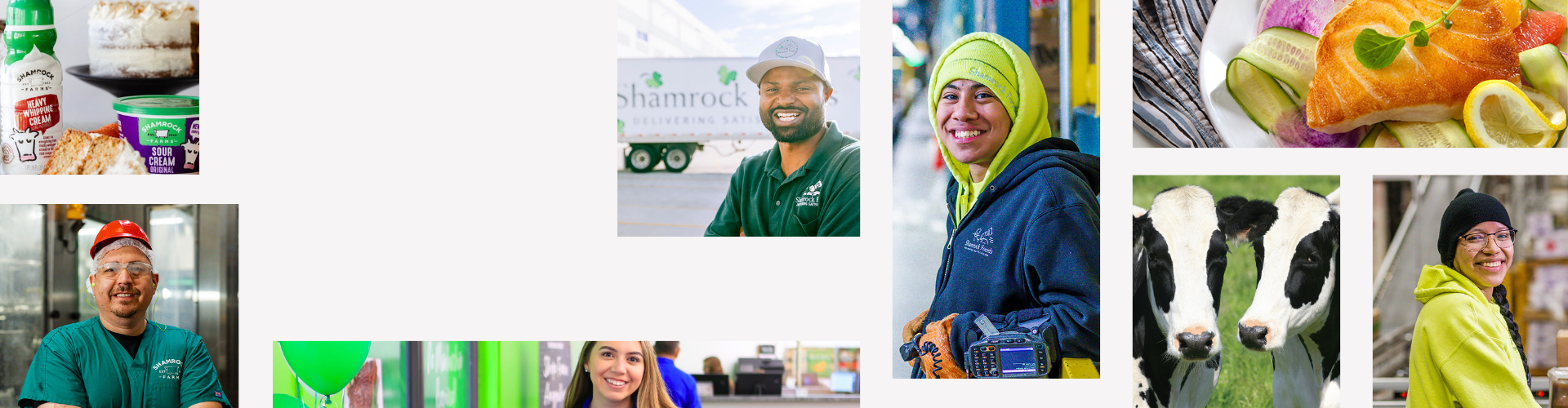

Welcome to Shamrock Foods Company! Our family-owned and -operated company has been treating associates as family and customers and suppliers as friends for over 100 years. Today, we serve customers across the nation through our family of companies, including Shamrock Foods, the largest independant foodservice distributor in the West and Shamrock Farms, one of the largest family-owned dairies nationwide.

We offer our employees, who we call associates, more than just a job- we offer a career with endless opportunities for growth. From award-winning benefits to best-in-class compensation, we care for you and your family through Shamrock's Total Wellbeing program which focuses on caring for your physical health, financial wellbeing, sense of community, continued learning plan, and overall happiness.

By caring for the whole person, we are creating an enviroment where you're able to do your best every day at work and be your best outside of work.

We offer our employees, who we call associates, more than just a job- we offer a career with endless opportunities for growth. From award-winning benefits to best-in-class compensation, we care for you and your family through Shamrock's Total Wellbeing program which focuses on caring for your physical health, financial wellbeing, sense of community, continued learning plan, and overall happiness.

By caring for the whole person, we are creating an enviroment where you're able to do your best every day at work and be your best outside of work.

EXPLORE OUR TEAMS

EXPLORE OUR TEAMS

TRANSPORTATION

WAREHOUSE

SALES

PROFESSIONAL

MANUFACTURING

RETAIL

JOIN OUR TALENT COMMUNITY

A TOP 20 HEALTHIEST

EMPLOYER IN THE U.S.

EMPLOYER IN THE U.S.

In 2023, Shamrock Foods Company was named one of the top 20 Healthiest Employers in the U.S. by Healthiest Employers©. Click to learn more about our award-winning benefits.

Best-in-Class Benefits

Our award-winning benefits are made affordable and easily accessible to you & your family.

Variety of Schedules

We offer a variety of schedules including days and nights so you can find the balance that best suits you.

Leaders Who Care

Many Shamrock leaders began in entry-level positions and know how to best help you grow in your career.

SHAMROCK FOODS

Shamrock Foods is the largest family-held foodservice

distributor in the Western U.S. delivering to restaurant,

hospitality, and institutional foodservice customers.

distributor in the Western U.S. delivering to restaurant,

hospitality, and institutional foodservice customers.

SHAMROCK FARMS

Shamrock Farms has evolved milk beyond the traditional

gallon, even creating entirely new categories like Rockin’ Protein,

the first ready-to-drink milk-based protein beverage.

gallon, even creating entirely new categories like Rockin’ Protein,

the first ready-to-drink milk-based protein beverage.

SHAMROCK

FOODSERVICE WAREHOUSE

FOODSERVICE WAREHOUSE

Shamrock Food Service Warehouse offers a fresh

shopping experience with access to more than 7,000

foodservice and wholesale grocery products. Open to the

public with no membership required.

shopping experience with access to more than 7,000

foodservice and wholesale grocery products. Open to the

public with no membership required.